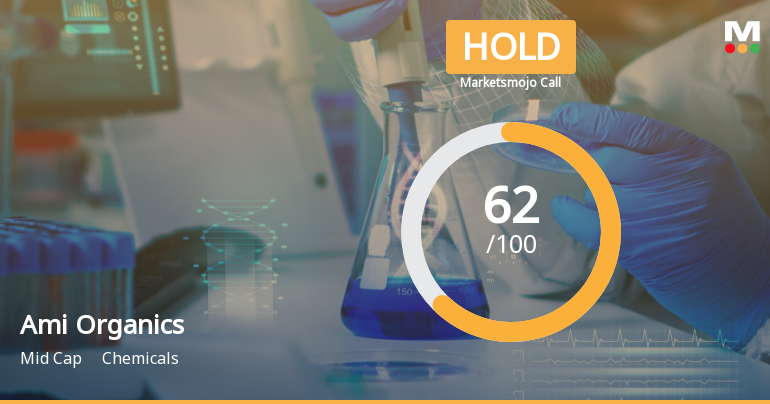

Ami Organics, a midcap player in the chemicals industry, has recently seen its stock call downgraded to ‘Hold’ by MarketsMOJO as of January 6, 2025. The company reported a significant net profit growth of 155.75% in its September 2024 results, with operating cash flow reaching a record Rs 125.17 crore and net sales hitting Rs 246.73 crore. The operating profit to interest ratio also stood impressively at 97.86 times.

Despite these positive indicators, Ami Organics faces challenges in long-term growth, with an annual operating profit growth rate of only 12.98% over the past five years. The company’s return on equity (ROE) is at 7.8, and it carries a price-to-book value of 7.2, indicating a relatively expensive valuation compared to historical averages.

Institutional holdings in the company are robust at 33.8%, having increased by 6.07% in the previous quarter. The stock has demonstrated market-beating performance, generating an 82.47% return over the last year and outperforming the BSE 500 index in various time frames. However, the PEG ratio stands at 72.2, reflecting concerns about its valuation relative to profit growth.